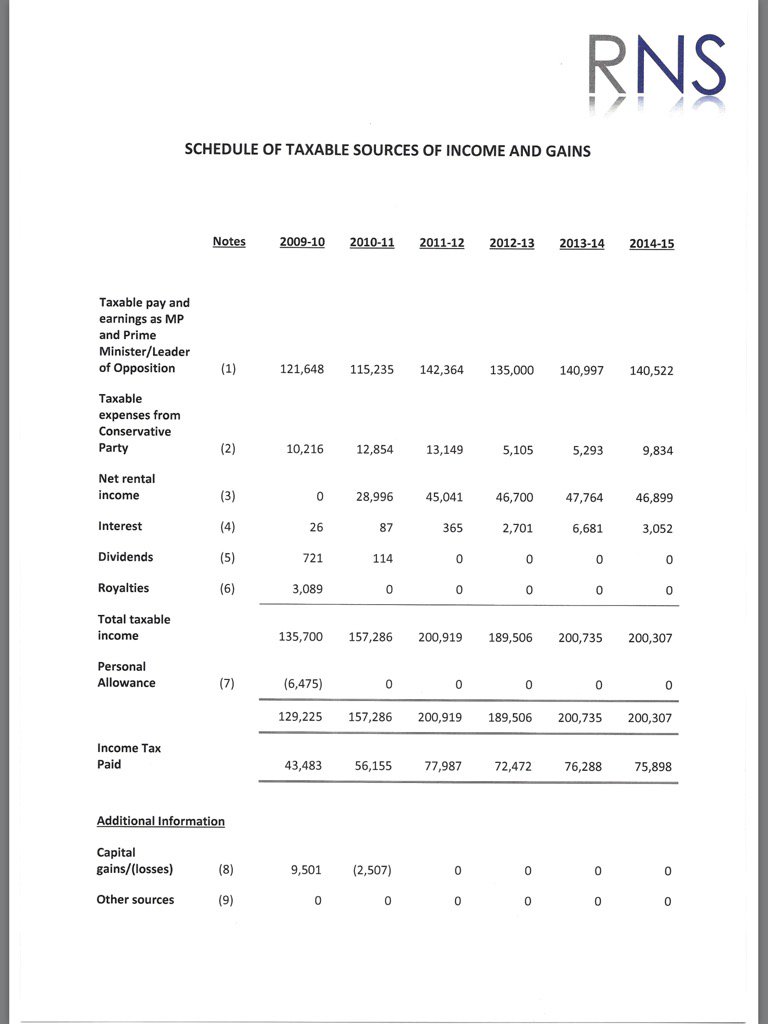

British Prime Minister David Cameron released his tax returns for the last six years after a week of criticism over his connections to the ongoing Panama Papers story.

Cameron is the first prime minister in U.K. history to publish personal details about his finances, including his annual tax returns.

UK Prime Minister David Cameron releases six years of tax returns https://t.co/evzpw8Dc44 pic.twitter.com/4tFd2JSPEL

— BBC News Graphics (@BBCNewsGraphics) April 10, 2016

Along with laying out his income, it also gives an insight into his wealth and, most crucially, the profit he made from holding shares in an offshore fund his late father had helped set up.

It has also raised questions over a gift of £200,000 ($284,000) from his mother in 2011, which has been described to offset the fact his brother was given the family home. But as the £200,000 was a gift from his mother, it was not subject to inheritance tax as it would have been if it had been left to him in his mothers will.

The key points of Cameron’s tax return release

- Rental income of £90,000 ($128,000) a year on his Notting Hill family home in west London – split with wife – while he lives at 10 Downing Street as prime minister.

- When rental income is taken into account, his total income puts him into the top rate tax band. He benefited from a cut in that rate from 50p to 45p in 2013.

- Used the special tax free allowance available to PM’s in his first year in office, but stopped claiming it in following years resulting in him having to pay £38,000 ($54,000) in extra tax.

- Received a gift of £200,00 ($284,000) from his mother in 2011.

(Image: ITV News)